Our story

A New Chapter Begins

Driven by a spirit of innovation and determination, we established the liquefied natural gas (LNG) industry in Australia 35 years ago and today supply a growing base of customers.

We are a global energy company founded in Australia, providing reliable and affordable energy to help people lead better lives.

The world needs energy that is affordable, reliable and lower carbon to support a successful energy transition. We provide energy to heat and cool homes, keep lights on and support industry.

We aim to thrive through the global energy transition with a low cost, lower carbon, profitable, resilient and diversified portfolio.1

The merger with BHP’s petroleum business has increased the scale and diversification of our global portfolio, which includes oil and gas assets and interests in Australia, the Gulf of Mexico, the Caribbean, Senegal, and Timor-Leste. We also have a focused exploration program.

Our focus in operations remains on safety, reliability, efficiency and environmental performance, leveraging more than 35 years of operating experience.

Our projects and growth opportunities

We have growth opportunities across gas, oil, and new energy.

Woodside has several projects currently in execution phase. The Scarborough and Pluto Train 2 projects in Australia achieved a positive final investment decision (FID) in November 2021 and are targeting first LNG cargo in 2026. In Senegal, the Sangomar Field Development Phase 1 is targeting first oil in mid-2024. In the United States Gulf of Mexico, Shenzi North, a brownfield expansion of the Shenzi oil project, is targeting first oil in 2024 and development of the southern flank of the Mad Dog field production was successfully achieved in April 2023. Woodside completed front-end engineering design for the Trion oil project in 2022. In June 2023, an FID was taken on this project.

Our marketing, trading and shipping activities enable us to supply a diverse range of customers from our recently expanded global portfolio.

Our approach to climate and sustainability

Woodside's climate strategy is integrated throughout our company strategy: our aspiration to thrive through the energy transition with a low cost, lower carbon, profitable, resilient and diversified portfolio1

Our climate strategy contains two key elements:

- reducing our net equity Scope 1 and 2 greenhouse gas emissions and

- investing in products and services for the energy transition.

Each element of our strategy is supported by the detail in our Climate Transition Action Plan and 2023 Progress Report which is expected to continue to evolve over time, and will be updated in future disclosures.

See our Climate page for further information.

1 For Woodside, a lower carbon portfolio is one from which the net equity Scope 1 and 2 greenhouse gas emissions, which includes the use of offsets, are being reduced towards targets, and into which new energy products and lower carbon services are planned to be introduced as a complement to existing and new investments in oil and gas. Our Climate Policy sets out the principles that we believe will assist us achieve this aim.

We apply a sustainability mindset to guide decision making at all levels of the business

We have elevated summary disclosures of our material sustainability topics to the Annual Report, retired the publication of a standalone annual Sustainable Development Report and included additional information on our website. We refreshed our Sustainability Strategy in 2023, to incorporate relevant sustainability-related risks and opportunities and reflect the direction of our business. The Sustainability Strategy supports our Corporate Strategy and places an increased focus on those sustainability topics most relevant to our current business activities and the communities where we are active.

See our sustainability strategy and plan for further information.

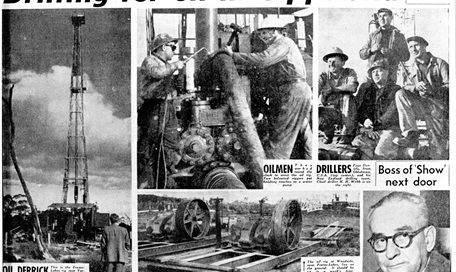

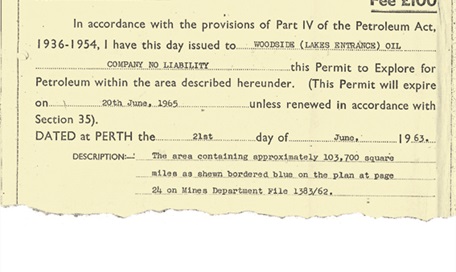

A history of achievement

Our proven track record and distinctive capabilities are underpinned by more than 65 years of experience.

.tmb-r-story.jpg?sfvrsn=a7492a2d_3)