Net equity Scope 1 and 2 emissions reduction targets2

-

15% by 2025

-

30% by 2030

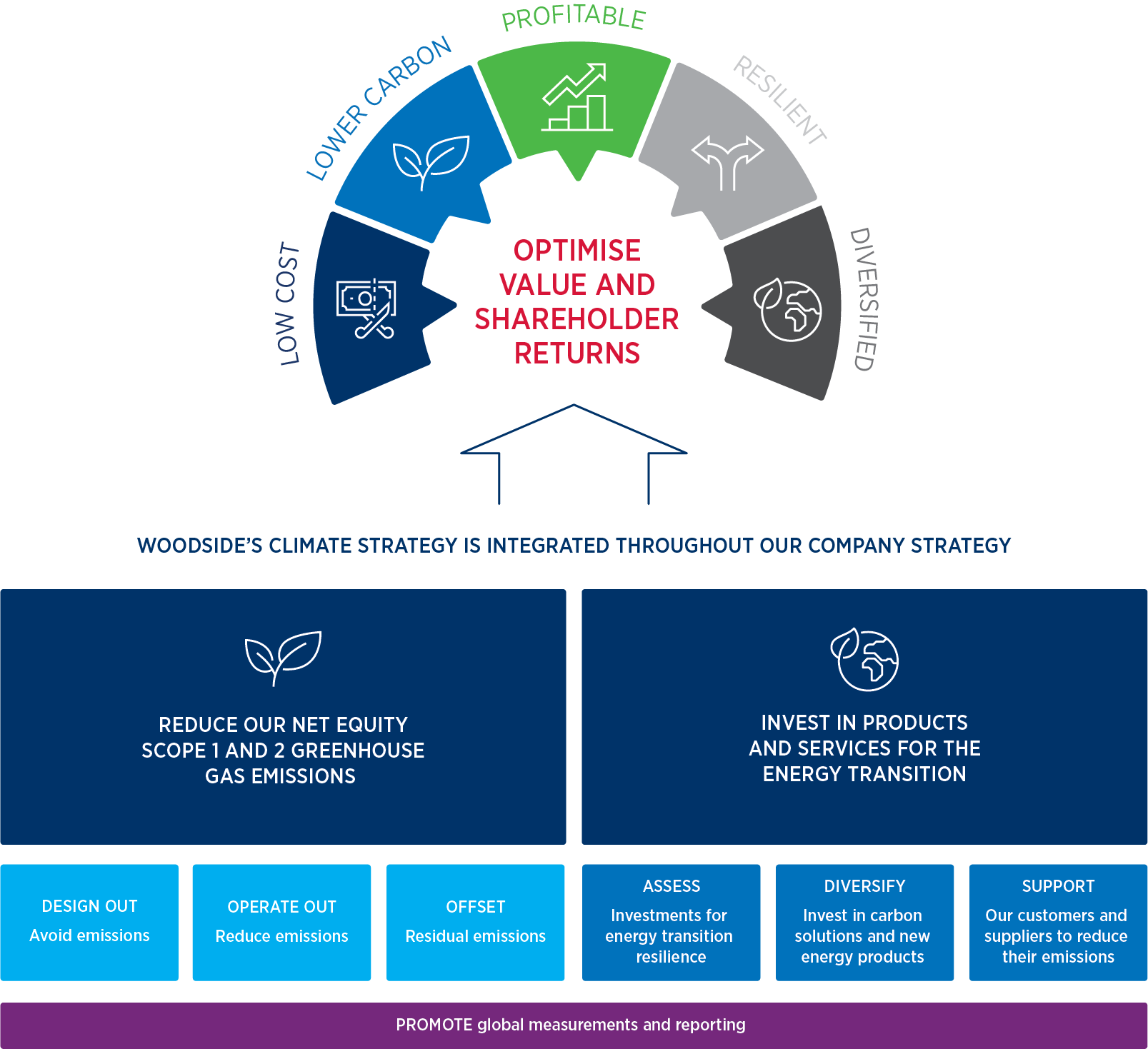

Woodside's climate strategy is integrated throughout our company strategy.

Our climate strategy contains two key elements:

Each element of our strategy is supported by the detail in our Climate Transition Action Plan and 2023 Progress Report which is expected to continue to evolve over time, and will be updated in future disclosures.

15% by 2025

30% by 2030

US$5 billion4

5 Mtpa CO2-e

US$335 million

The categories of potential climate-related opportunities include: resources efficiency, energy sources, products and services, markets and resilience.

The categories of potential climate-related risks include: transition risks such as policy and legal risks, technology, market, and reputation; physical risks such as acute, and chronic. See our 2023 annual report.

Our climate-related opportunities and risks are outlined below and also described in detail in section 5.0 of the Climate Transition Action Plan and 2023 Progress Report.

This includes detail of how these processes are integrated into Woodside’s overall risk management framework.

This is an abbreviated summary of our Climate Transition Action Plan and 2023 Progress Report (CTAP) which should be read in full.

Woodside has also provided more detail in our Response to investor feedback (expanding from CTAP pg.9).

Woodside is targeting a reduction of net equity Scope 1 and 2 greenhouse gas emissions of 15% by 2025 and 30% by 2030, with an aspiration of net zero by 2050 or sooner.1 Our performance against these targets is highlighted in the highlights section.

Reducing our net equity Scope 1 and 2 greenhouse gas emissions is supported by three levers:

Woodside has a long standing focus on energy efficiency. Our first formal climate-related target was a 5% energy efficiency target over the period 2016-2020. We exceeded this target, achieving 8%.

Click on each of the following topics to view more about it.

Investing in products and services for the energy transition is supported by three levers:

Click on each of the following topics to view more about it.

See the ‘highlights’ section above, and the Climate Transition Action Plan and 2023 Progress Report for more information.